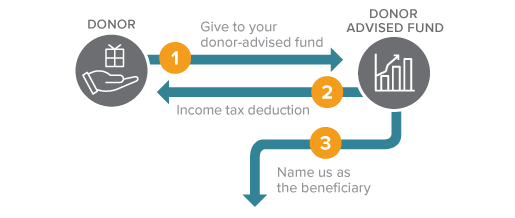

Giving From Your Donor-Advised Fund

Make an outright gift from your donor-advised fund OR name us as the ultimate beneficiary of the remainder in the fund.

How It Works

- Name St. Joseph’s Hospitals Foundation as a beneficiary of your donor-advised fund (DAF).

- Designate us to receive all or a portion of the balance of your fund on your passing.

- The balance in your fund passes to St. Joseph’s Hospitals Foundation when the fund terminates.

- During your lifetime you can also make grants to St. Joseph’s Hospitals Foundation from your donor-advised fund. See how a DAF works.

Benefits

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Maintain flexibility to change beneficiaries if your needs change during your lifetime.

- You can also direct your DAF to other charitable causes.

Next

- More detail on Donor-Advised Funds.

- Frequently asked questions on Donor-Advised Funds.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.

Explore More Gift Options

Will or Trust →

You can plan a gift that will not affect your cash flow.

Appreciated Securities →

Take advantage of appreciated securities, avoid tax.

Life Insurance →

Make a significant gift, no matter the size of your estate.

Retirement Plan →

Donate double-taxed assets and leave more to family.

Real Estate →

Donate a valuable asset, receive powerful tax benefits.

Personal Property →

Donate personal property, receive significant tax benefits.

Donor-Advised Fund →

Make a gift from your DAF, or name us a beneficiary.