Charitable Remainder Annuity Trust

You want the flexibility to invest and manage your gift plan, and also the security of stable income.

How It Works

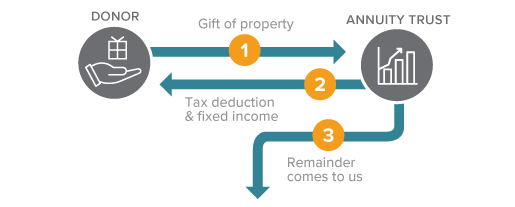

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to St. Joseph’s Hospitals Foundation to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.

Next

- More detail about Charitable Remainder Annuity Trusts.

- Frequently asked questions on Charitable Remainder Annuity Trusts.

- Related Gift: Charitable Remainder Unitrust.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.

Explore More Gift Options

Charitable Gift Annuity →

Give a gift of cash or stock, receive income in return.

Deferred Gift Annuity →

Younger donors can make a gift and lower taxable income.

Charitable Remainder Unitrust →

Maximum flexibility over gift plan investment, benefits.

Charitable Remainder Annuity Trust →

Flexibility to manage your gift; security of stable income.